Investing early in life is a cornerstone of financial wisdom, offering a powerful advantage that even the wealthiest can’t buy: time. The magic of compounding can turn modest but consistent early savings into significant wealth.

Lessons from Warren Buffett

Billionaire investor Warren Buffett is a prime example of the immense value of compounding. Buffett started investing in his early teens, and his long-term approach has been central to his success. The power of compounding over such an extended period played a crucial role in his wealth accumulation. Buffett once said “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.”.

The Early Bird Advantage

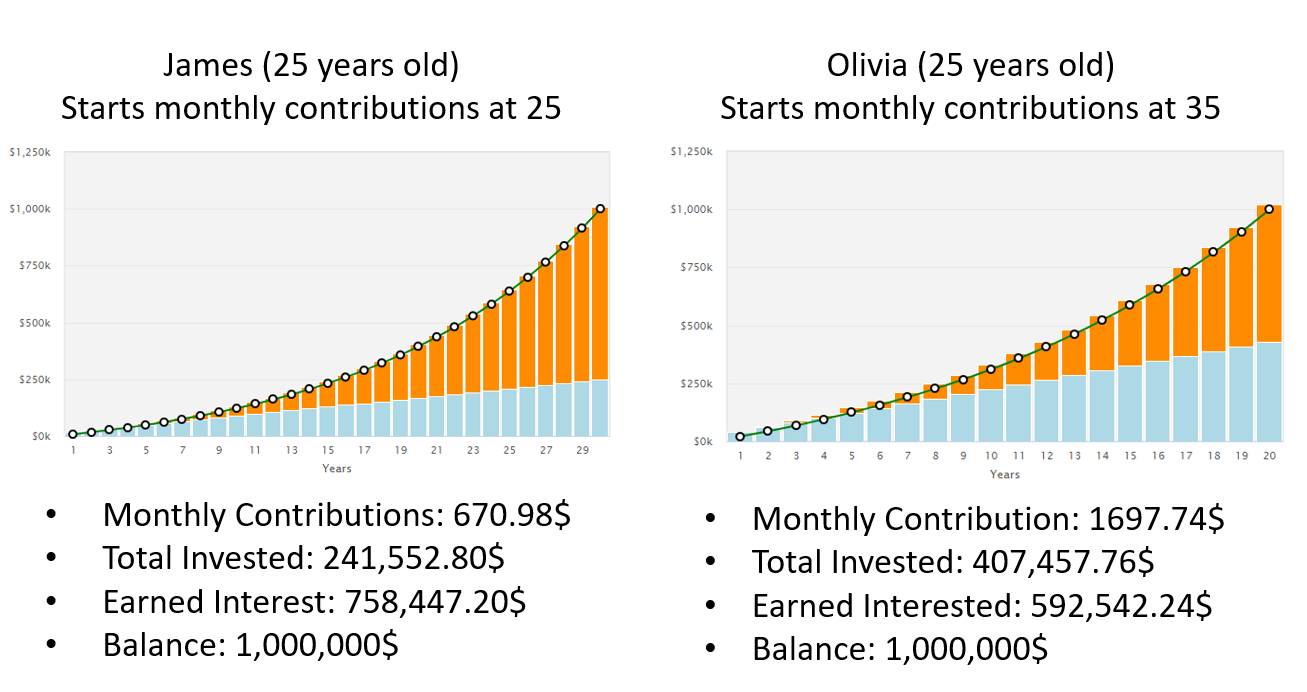

Starting young is crucial. In this scenario, we examine the investment journeys of two people, James and Olivia, both aiming to reach a million-dollar milestone by 55. They each anticipate an 8% compounded annual return on their investments, a realistic expectation for a long term growth investor. The key difference lies in their starting points: James begins his savings endeavor at the age of 25, while Olivia starts at 35. This gap in their investment timelines serves as a great example of the impact early savings and the power of compounding have over time.

The lesson is clear: the earlier one starts investing, the greater the potential for wealth accumulation. The combination of regular savings, prudent investment choices, and the power of compounding over time can create substantial financial security. This principle is a universal truth in wealth accumulation.

The calculator below demonstrates how monthly deposits, no matter how modest, can grow significantly over time. We encourage you to use it to personalize this concept.

See for yourself the difference that starting today can make in your financial journey.

Disclaimer:

The information provided in this response is based on general principles and is intended for informational purposes only. It should not be considered as legal, financial, or professional advice. For specific guidance it is essential to consult with a qualified legal or financial professional who can assess your unique situation and provide advice tailored to your specific circumstances.