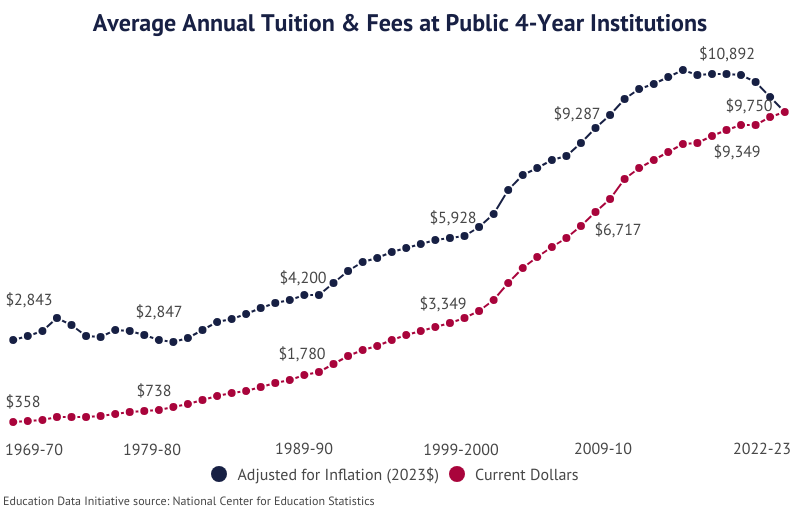

The rising cost of education in the United States has been a hot topic for years, as tuition continues to climb far beyond inflation rates. Between 1980 and 2020, the average cost of college more than doubled after adjusting for inflation, leaving many to question whether higher education is still a worthwhile investment. This article will quickly explore the reasons behind the cost explosion, the long-term value of a degree, and whether reform is needed to keep education accessible.

Rising Costs: What’s Driving the Increase?

1. Administrative Bloat

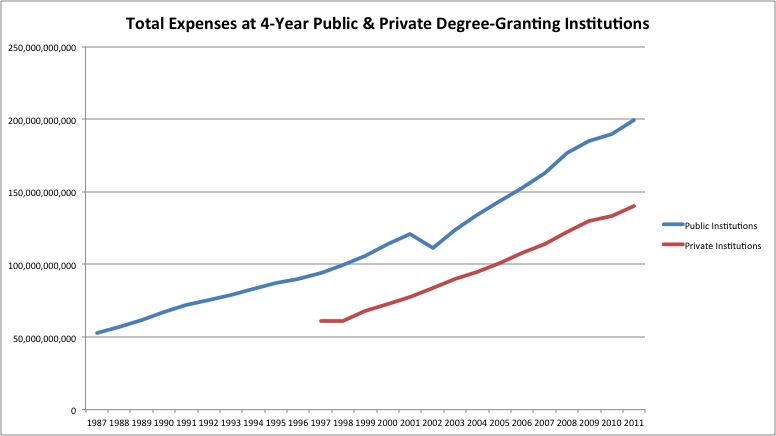

One of the most significant contributors to rising college costs is the explosion in administrative positions. From 1993 to 2009, the number of non-academic administrative roles grew by 60%, heftily increasing overall overhead costs. This surge has made colleges more bureaucratic, with more staff needed to manage the complexities of modern universities, from compliance with regulations to marketing and recruitment.

2. The Amenities Arms Race

Colleges are increasingly competing by offering luxury amenities to students, such as high-end dorms, state-of-the-art gyms, and even lazy rivers. These are attractive to prospective students but come with a hefty price tag, often passed on through higher tuition and fees. The emphasis on creating an exceptional campus experience means schools invest more in capital improvements, which drives up costs further.

Source: National Center for Education Statistics (NCES), Integrated Postsecondary Education Data System (IPEDS), Finance component Note: Institutions selected include only 2,284 degree-granting 4-year and above public and private not-for-profit institutions in the United States.

3. Declining State Funding

Public universities, in particular, have seen state funding drop over the past few decades, forcing schools to raise tuition to cover the shortfall. State support for higher education fell from covering 60% of costs in the 1970s to less than 30% today in some states. As a result, students and families have to bear a larger portion of the burden.

4. Demand for Degrees

With more industries requiring degrees for even entry-level positions, demand for higher education has surged. Employers’ increasing reliance on degrees as a baseline qualification has driven students to pursue higher education in greater numbers. This heightened demand enables schools to raise tuition, as students are willing to pay for the perceived career advantages a degree provides. From 2000 to 2018, undergraduate enrollment in degree-granting institutions rose by 26%.

Is a College Degree Worth the Price?

Despite its high cost, higher education remains a solid investment for many. In 2020, workers with a bachelor’s degree earned an average of $524 more per week than those without one, translating to significant lifetime earnings.

However, the return on investment (ROI) depends heavily on the degree and career path. STEM and business degrees often yield high returns, with fields like engineering and computer science producing lifetime earnings of $1 million or more. On the other hand, degrees in arts or humanities may offer low or even negative financial value, especially when coupled with student loan debt.

For students who don’t finish their degrees or enter low-paying fields, the ROI can diminish significantly. Careful financial planning is essential to make higher education a worthwhile investment.

Careful financial planning is essential to make higher education a worthwhile investment. For parents preparing to support their child’s college journey, our wealth management services provide tailored strategies to meet your financial goals.

Is Reform Necessary?

The rising cost of education and the uneven return on investment have prompted calls for reform. Some suggestions include:

- Expanding financial aid and scholarships: More targeted aid for middle-class families, who often don’t qualify for significant help, could alleviate some of the financial strain.

- Investing in trade schools: For some careers, vocational training or apprenticeships may offer better value than a traditional four-year degree. Expanding access to these programs could provide alternatives for students who might not benefit from college.

- Reducing administrative costs: Streamlining administrative functions and cutting unnecessary staff could lower overhead costs and reduce tuition hikes.

The Role of AI and Online Learning

In addition to traditional reforms, the growing role of AI and online learning platforms could help alleviate these high costs. By offering affordable and flexible alternatives to college degrees, AI-powered educational tools provide personalized learning experiences at a fraction of the price. As more students turn to these options, the increased competition may also drive traditional institutions to reconsider their pricing.

Conclusion

While the cost of higher education in the U.S. is undeniably high, for many, the investment is still worthwhile—especially in fields that offer high salaries and career stability. However, not all degrees offer the same returns, and careful financial planning is essential to make college affordable and beneficial. Reform efforts could help make education more accessible and ensure that students are getting value for their investment. In the end, deciding whether college is worth the cost comes down to individual circumstances, career goals, and financial realities. But for many, despite the high price tag, the long-term benefits of a degree still outweigh the costs.

Elevate Your Wealth

Stay informed with insights on personal finance, wealth-building strategies, and market trends. Sign up for our newsletter to get expert advice delivered straight to your inbox.

Disclaimer:

The information presented in this article is for educational and informational purposes only. While every effort has been made to ensure accuracy, the data and insights shared may not reflect the latest developments or individual circumstances. Readers are encouraged to conduct their own research and consult with professionals for personalized advice. The opinions expressed are those of the author and do not constitute financial or educational guidance. organization.